Quick – where were you 25 years ago?

The song, “Wannabe” by The Spice Girls was the #1 song in America in the spring, later followed by “MMMBop” by Hanson. “Men in Black” would dominate the summer box office, only to be dwarfed by “Titanic” later in the year. The San Antonio Spurs drafted Tim Duncan and the Houston Oilers football team moved to Tennessee. People were starting to worry about the dreaded “Y2K” bug.

Looking back a quarter of a century, so much has changed—from how we communicate, access and share information, to how we work and access investments, and more.

However, the need for investors to manage risk has not.

Founded in 1997, we are a leader in risk management and hedged equity strategies, focused on helping investors create and preserve wealth. We’ll look back over the last 25 years to provide observations and insights that may well serve investors seeking to manage risk today and for decades to come.

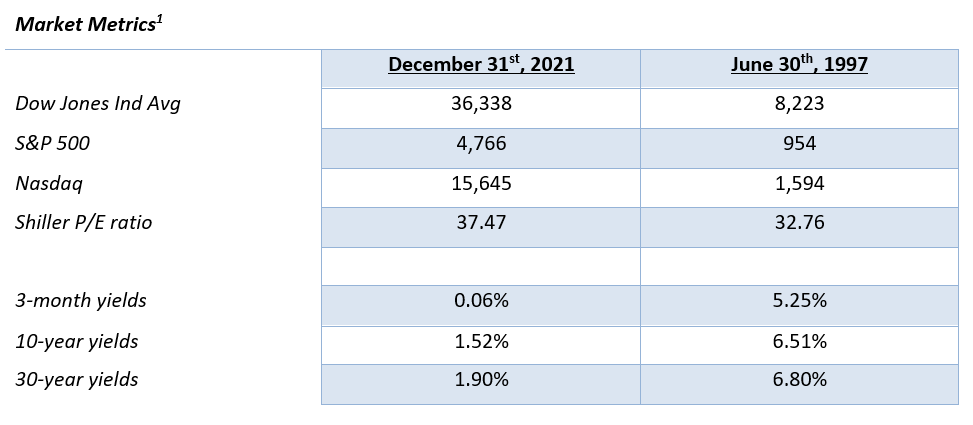

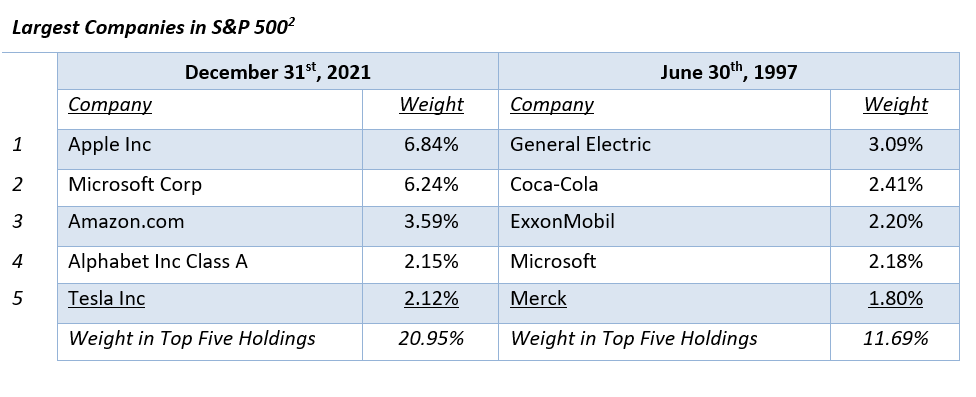

While cultural milestones like music, movies, or sporting events often serve to mark a time and a place, let’s look back a quarter of a century at the capital markets.

Today, the picture is vastly different.

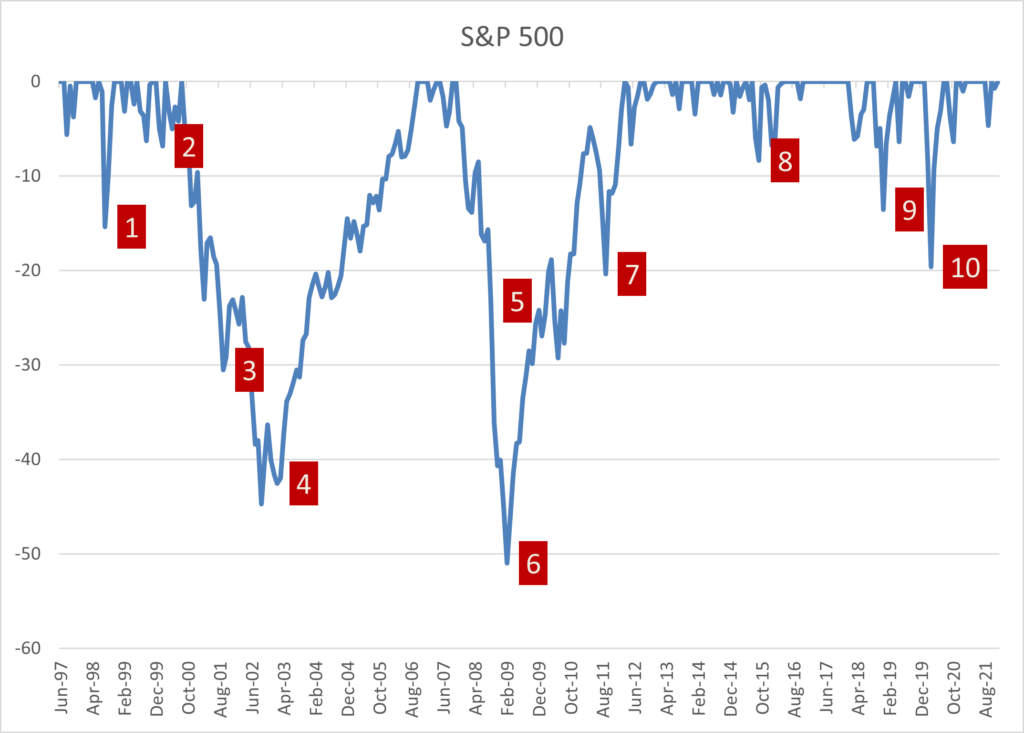

While the market has grown by leaps and bounds over the last 25 years, the ride was far from smooth. Numerous calamities have impacted the market, including the two largest bear markets since World War II and a once-in-a-century global pandemic.

Source: Zephyr Associates, Swan Global Investments

While the previously mentioned Y2K bug turned out to be a non-issue, the last twenty-five years have seen a multitude of crises, challenges, and calamities, including:

It was for reasons such as these that Randy Swan started Swan Global Investments and the Defined Risk Strategy (DRS) in July 1997. The goal was to design an investment strategy that addressed the shortcomings of traditional asset allocation. Traditional asset allocation seeks to mitigate risk through diversification, but one of the main caveats of asset allocation is that market risk cannot be diversified away. To Swan, leaving the biggest source of risk unaddressed was unacceptable. Therefore, if market risk cannot be diversified away, the DRS sought to hedge it away.

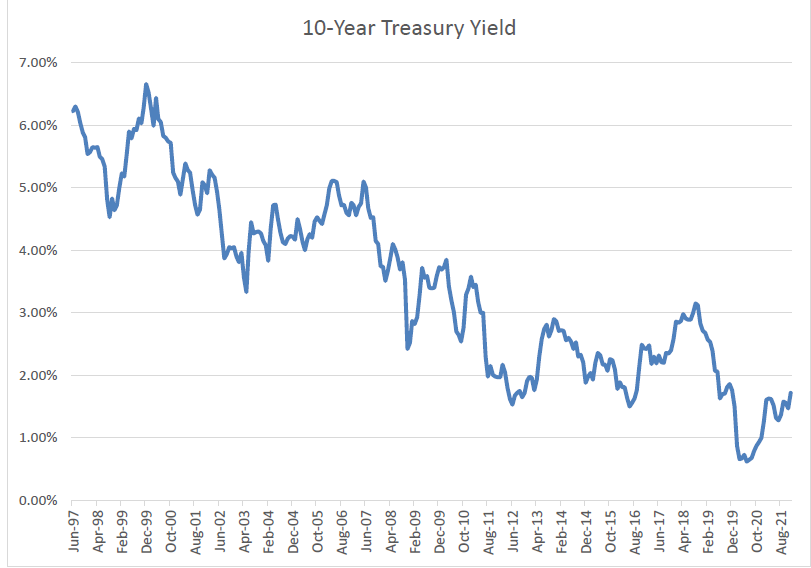

Today, 25 years after the inception of the Defined Risk Strategy, traditional asset allocation is under more pressure than ever. While equity market risk has not gone away, the capacity of bonds to offset equity losses has been severely diminished. This may be the biggest change in the capital markets, with long-term ramifications, for investors.

Previously bonds were able to provide both income and capital preservation in a portfolio. However, given the extremely loose monetary policy of the last two decades, investors must now choose between income or capital preservation. If inflation continues to be a problem, they might end up with neither.

Source: https://www.multpl.com/10-year-treasury-rate/table/by-month

Further diminishing the value of bonds has been a tsunami of debt issuance. The Federal Reserve Bank’s balance sheet has ballooned to over $8 trillion following the Global Financial Crisis and the Covid-19 Pandemic. The price discovery mechanism of auctioning bonds on the open market was shattered as the Fed’s purchases were completely insensitive to the yield on the Treasuries. If anything, the overt goal of quantitative easing was to suppress yields to artificially low levels.

Simply put, bonds are painted into a corner. If rates stay low, bondholders will lose purchasing power as inflation surges. If rates rise, the principal value of their bond holdings will fall.

Beyond the ultra-low interest rate environment, what else has changed in the markets and the economy?

The combined effect of the above changes has increased the volatility of the markets. Some market commentators have dubbed this new environment “fragile” or “brittle.” For extended periods of time the market might seem fine and risks subdued. But when cracks to appear in the market they tend to be rapid and more intense than they’ve been historically. Examples of this include the U.S. Treasury debt downgrade of August 2011, the China slow-down fears of August 2015, and the “Volmageddon” spike of February 2018.

With equity markets still hovering around all-time highs, valuations nearly priced for perfection, yields near historic lows, volatility increasing, and inflation rising, the risks to investors reaching their long-term goals are abundant. Michael Burry, of “The Big Short” fame, recently summarized the current state of affairs as:

We believe the need for a hedged equity strategy is greater than ever.

While the markets have undergone significant changes, the overall goal of the Defined Risk Strategy remains the same: maximize the return-risk trade-off by minimizing the impact of down markets in order to improve the consistency of long-term investment outcomes. We remain “always invested, always hedged” by actively hedging our holdings in the market.

How has Swan delivered on this goal?

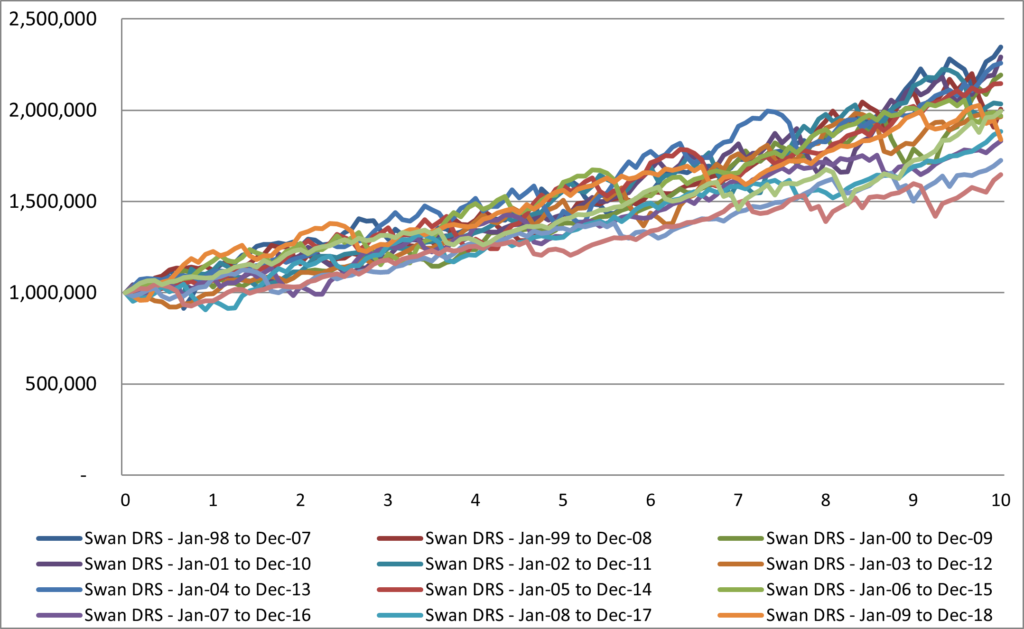

Source: Zephyr StyleADVISOR, Swan Global Investments

The above graph illustrates every rolling, 10-year calendar period since the DRS’s inception. All of the crises and market calamities listed previously are incorporated in this illustration. The DRS has displayed a remarkable consistency through the last quarter-century, with a 10-year annualized return ranging from 5.11% to 8.90%. In contrast, the unhedged S&P 500 has been “feast or famine”, with 10-year annualized returns ranging from -1.38% to 16.55%. See how the consistency of outcomes above for the DRS compares to the S&P 500 Index.

What has changed with Swan Global Investments since July 1997? Swan has expanded its range of hedged equity solutions to serve a wide array of investor needs. When originally conceived, the Defined Risk Strategy was a “one size fits all” solution. Today, Swan manages various hedged equity strategies to meet a wide range of investor needs and objectives.

Swan’s expanded offerings include:

• Managing mutual funds, separately managed accounts (SMAs), and ETFs

• Hedging a wide variety of asset classes including U.S. large cap, U.S. small cap, foreign developed markets, emerging markets, gold, and bonds

• Designing hedged equity solutions to different risk tolerance levels, with more conservative and more aggressive variants to suit client preferences

• Offering both actively managed and passive, defined outcome solutions, and customizing bespoke portfolio overlay solutions for clients with unique needs.

What might the future bring? By July 1st, 2047, what events will have occurred in the market? What innovations will be commonplace? What will the world look like?

No one knows. If the last twenty-five years are any guide for the next twenty-five, it is reasonable to expect bull markets and bear markets, unforeseen events, and a lot of volatility along the way. The DRS was designed as a full market cycle solution with meaningful upmarket participation and significant down-market protection. We look forward to the challenge.

Marc Odo, CFA®, FRM®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. His responsibilities also include producing most of Swan’s thought leadership content. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments is an SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (DRS). Please note that registration of the Advisor does not imply a certain level of skill or training. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance that future performance will be comparable to past performance. This communication is informational only and is not a solicitation or investment advice. Further information may be obtained by contacting the company directly at 970-382-8901